Introduction

Welcome! Are you looking for ways to improve your credit score using a credit card? Look no further! In this article, I will share with you 10 smart tips that can help boost your credit score effectively. Credit scores play a crucial role in our financial lives, determining whether we can secure loans, receive favorable interest rates, or even rent an apartment. Therefore, it’s essential to maintain a good credit score for a brighter financial future.

What is a credit score?

A credit score is a numerical representation of your creditworthiness. It is calculated based on your credit history, taking into account factors such as payment history, credit utilization, length of credit history, and new credit. The higher your credit score, the more likely lenders are to view you as a reliable borrower.

Importance of a good credit score

Having a good credit score opens doors to various financial opportunities. It allows you to qualify for better interest rates on loans, credit cards with more favorable terms, and increases your chances of securing a mortgage or renting a home. Additionally, employers, landlords, and insurance companies often use credit scores to evaluate trustworthiness and responsibility.

How credit cards can impact credit score

Credit cards can have a significant impact on your credit score. By using credit cards responsibly, such as making timely payments and keeping balances low, you can demonstrate good financial habits and improve your creditworthiness. On the other hand, misusing credit cards, such as maxing out your credit limit or consistently missing payments, can lead to a drop in your credit score.

Now that we understand the basics of credit scores and their importance, let’s delve into the ten smart tips for using credit cards to improve your credit score. By following these tips, you’ll be on your way to a better credit score and financial success. So, let’s get started!

Understanding Credit Scores

What factors determine credit scores?

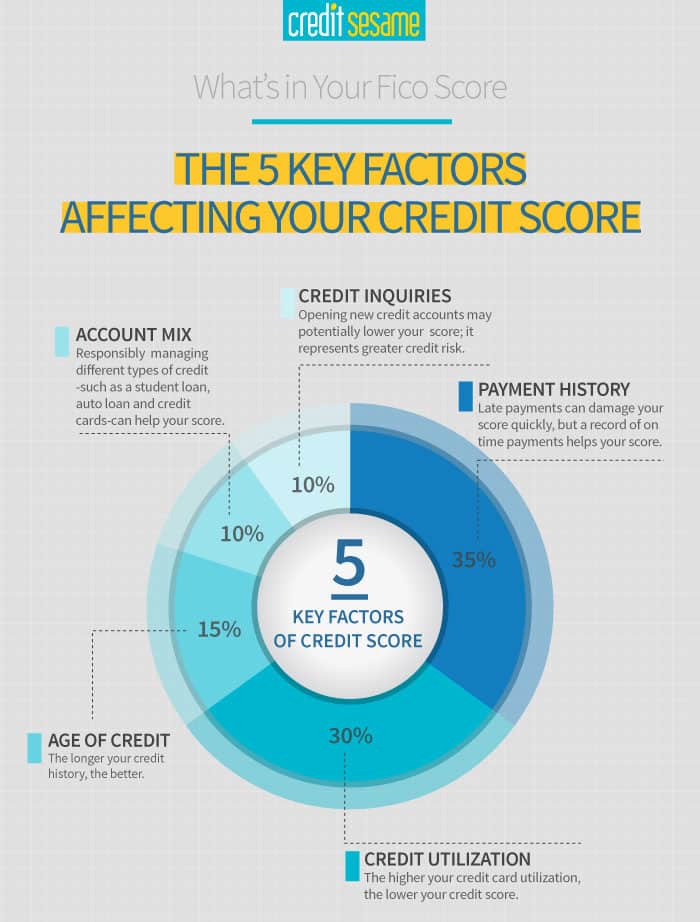

Credit scores are numerical assessments of an individual’s creditworthiness, and they play a crucial role in determining one’s financial health. Several factors contribute to the calculation of these scores. Firstly, payment history is a significant determinant, highlighting whether you make your credit card payments on time. Secondly, the amount owed on credit cards and loans is another crucial factor. Maintaining a low credit utilization ratio demonstrates responsible credit utilization. Additionally, the length of your credit history, the types of credit you use, and any recent credit inquiries can impact your credit score.

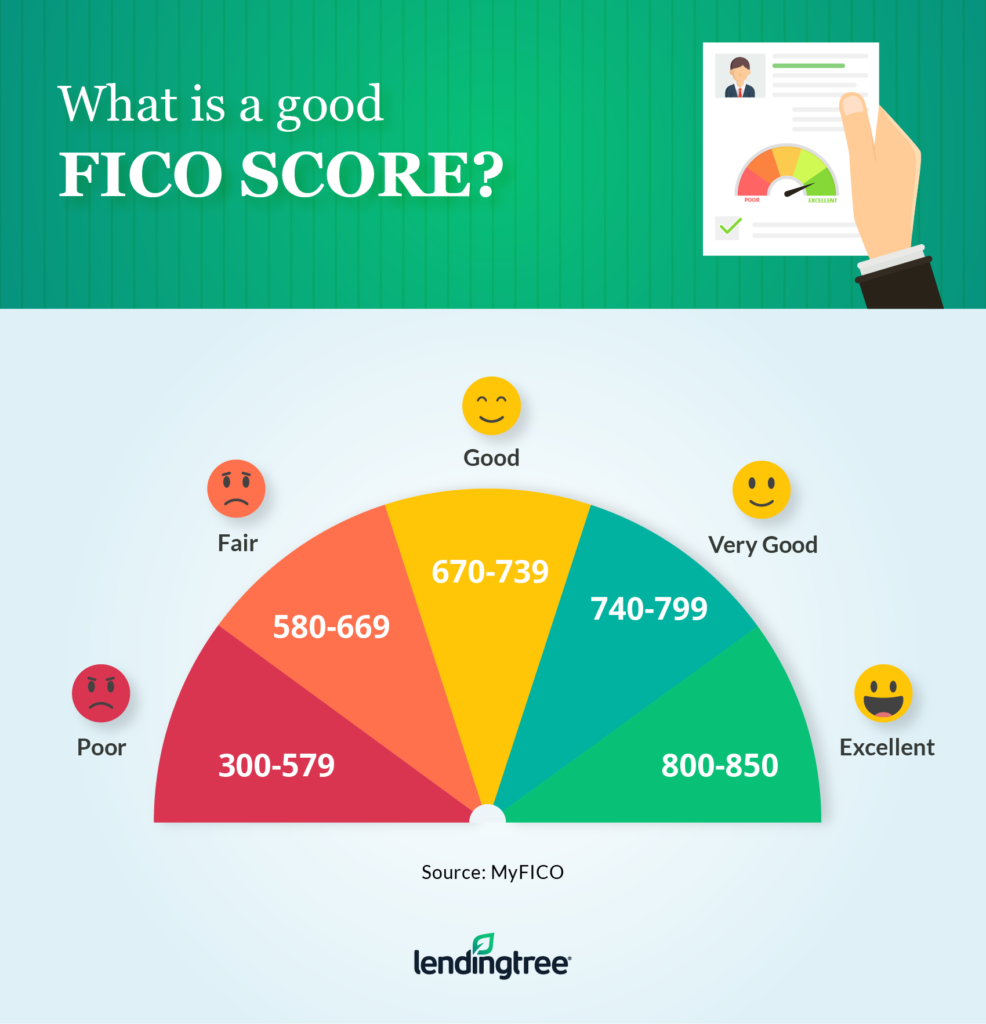

Different credit score ranges

Credit scores generally range from 300 to 850, with higher scores indicating better creditworthiness and a lower likelihood of defaulting on payments. The exact score ranges may vary slightly among different credit bureaus. For instance, a score above 800 is considered excellent, while a score between 670 and 739 is considered good. It’s important to familiarize yourself with the specific score ranges used by lenders to assess your creditworthiness.

Why credit scores are important for financial well-being

A good credit score not only helps secure favorable interest rates and loan terms but also affects your ability to rent an apartment, obtain insurance, or even land a job. It reflects your reliability when it comes to managing credit and paying off debts. By improving your credit score, you can gain access to better financial opportunities, saving you money in the long run.

In this article, I’ll provide you with ten smart tips for improving your credit score using your credit card. These tips are designed to help you understand how to make the most of your credit card usage and build a strong credit history. By following these strategies, you’ll be well on your way to achieving a higher credit score and improving your overall financial well-being.

Benefits of Using Credit Cards

Credit cards can be valuable financial tools when used responsibly. In addition to providing convenient payment options, credit cards offer several benefits that can help improve your credit score. Understanding these benefits can empower you to make smart decisions to enhance your creditworthiness.

Building a credit history

One of the most significant advantages of using a credit card is the opportunity to establish and build your credit history. By making regular, on-time payments and keeping your credit utilization low, you demonstrate your ability to responsibly manage credit. A positive credit history can increase your credit score over time, making it easier for you to qualify for better interest rates and loan products in the future.

Earning rewards and cashback

Many credit cards offer rewards programs that allow you to earn points, miles, or cashback on your purchases. By using your credit card for everyday expenses and paying off the balance in full each month, you can take advantage of these rewards. Not only can this help you save money, but it also shows lenders that you are a responsible borrower who can handle credit responsibly.

Enhanced consumer protection

Credit cards often come with added consumer protection benefits, such as purchase protection and extended warranties. These features can offer you peace of mind when making significant purchases, as they provide an additional layer of security and financial protection. By using your credit card for certain transactions, you can take advantage of these valuable safeguards.

using a credit card wisely can have a positive impact on your credit score. By taking advantage of the benefits offered by credit cards, such as building a credit history, earning rewards, and enhanced consumer protection, you can improve your creditworthiness and unlock better financial opportunities in the future. So, start using your credit card responsibly today and reap the benefits it has to offer.

Smart Tips for Improving Credit Score

As someone who understands the importance of good credit, I have learned some smart tips for improving my credit score using credit cards. By following these tips, I have seen significant improvements in my creditworthiness over time.

Paying bills on time

One of the most crucial factors in maintaining a good credit score is paying bills on time. Late or missed payments can negatively impact your credit history, so it is essential to set up reminders or automatic payments to ensure timely payments.

Keeping credit utilization low

Another important aspect of credit score improvement is keeping credit utilization low. This means using only a small portion of your available credit limit. Maintaining a low credit utilization ratio demonstrates responsible credit usage to lenders and can positively affect your credit score.

Regularly checking credit reports

Regularly checking your credit reports allows you to identify and correct any errors or discrepancies promptly. Monitoring your credit reports also enables you to stay updated on your payment history, credit balances, and overall creditworthiness.

Avoiding unnecessary credit applications

Each time you apply for new credit, a hard inquiry is placed on your credit report, which could lower your credit score. It is important to avoid unnecessary credit applications, only applying for credit when absolutely necessary.

By implementing these smart tips, I have seen my credit score steadily improve over time. Maintaining a good credit score has not only given me access to better credit opportunities but also provided me with peace of mind knowing that I am in control of my financial future.

Utilizing Credit Card Features

When it comes to improving your credit score, maximizing the features and benefits of your credit card can play a significant role. Here are three tips to help you make the most of these features and boost your creditworthiness.

Setting up automatic payments

Setting up automatic payments for your credit card bills can be a smart move to ensure you never miss a payment again. By enabling this feature, you can avoid late fees and penalties while building a consistent payment history, a crucial factor in determining your credit score. As long as there are sufficient funds in your account, your credit card bill will be paid on time, improving your creditworthiness.

Using credit limit increases strategically

Periodically requesting a credit limit increase can positively impact your credit score by lowering your credit utilization ratio. However, it’s essential to use this feature strategically. Instead of using the additional credit to splurge on unnecessary purchases, consider keeping your spending habits the same while benefiting from a lower credit utilization percentage. This responsible usage will demonstrate financial discipline and potentially boost your credit score.

Taking advantage of balance transfer options

If you’re struggling with high-interest debt on a different credit card, a balance transfer can help you consolidate your debt and potentially reduce interest payments. By transferring your outstanding balances to a credit card with a lower interest rate, you can pay off your debt more efficiently. This responsible utilization of credit card features can positively impact your credit score by reducing your overall debt and giving you more control over your finances.

By following these tips and fully utilizing the features of your credit card, you can pave the way for a better credit score and financial success. Remember, responsible credit card usage is essential in building and maintaining a good credit history.

Maintaining a Positive Credit Card Behavior

Avoiding carrying high balances

One of the key factors that influence your credit score is the amount of debt you carry on your credit cards. Carrying high balances can negatively impact your credit score, as it indicates a potential risk of defaulting on payments. To improve your credit score, it’s crucial to keep your credit card balances low. Aim to utilize no more than 30% of your total available credit limit. If you regularly carry high balances, consider paying down your debt or requesting a credit limit increase to help lower your credit utilization ratio.

Paying more than the minimum amount due

While making at least the minimum payment is important, it’s even better to pay more than the minimum amount due each month. By paying more, you not only reduce your outstanding balance faster but also demonstrate responsible credit management. Remember, each on-time payment contributes to building a positive payment history, which is a significant factor for credit score calculation.

Using credit cards responsibly

To maintain a positive credit card behavior, it’s important to use your credit cards responsibly. Only charge what you can comfortably afford to pay off each month. Avoid maxing out your cards or making impulse purchases that could lead to financial strain. Develop a budget and financial plan to ensure you can meet your credit card obligations without accumulating excessive debt.

By following these smart tips for improving your credit score with credit cards, you can build a strong credit history and improve your overall financial health. Remember, a positive credit score opens doorways to better loan terms, lower interest rates, and more opportunities for financial success.

Dealing with Credit Card Debt

Dealing with credit card debt can be a daunting task, but with the right approach and a clear plan, it is possible to improve your credit score and regain control over your finances. Here are some smart tips to help you on your journey towards a better credit score:

Creating a repayment plan

The first step in tackling credit card debt is to create a repayment plan. Start by assessing your current financial situation and determining how much you can realistically afford to pay towards your credit card balances each month. Prioritize high-interest debts and consider paying more than the minimum payment to reduce the overall interest charges. Stick to your repayment plan religiously and avoid using your credit cards for unnecessary expenses.

Seeking professional help if needed

If your credit card debt feels overwhelming or if you are struggling to make progress on your own, don’t hesitate to seek professional help. Credit counseling agencies can provide guidance on budgeting, debt management plans, and negotiating with creditors. They can also offer valuable resources and support to help you improve your credit score.

Considering debt consolidation options

Another option to streamline your debt repayment is debt consolidation. This involves combining multiple debts into one, usually with a lower interest rate. Debt consolidation through a personal loan or balance transfer credit card can simplify your finances and potentially save you money on interest charges. However, it is essential to carefully review the terms and fees associated with consolidation options before making a decision.

By following these smart tips, you can gradually improve your credit score and achieve financial freedom. Remember, it takes time and consistent effort, but with determination, you can successfully overcome credit card debt and navigate towards a brighter financial future.

Conclusion

Summary of key points

In conclusion, improving your credit score with a credit card is an achievable goal with the right strategies and consistent management. By following these 10 smart tips, you can take control of your credit and pave the way for a brighter financial future.

Throughout this article, we discussed the importance of understanding your credit utilization and keeping it low, as well as the benefits of paying your bills on time and in full. We also explored the advantages of diversifying your credit mix and being mindful of opening new accounts.

Consistently monitoring your credit report and disputing any errors or inaccuracies is crucial in maintaining a healthy credit score. Additionally, practicing responsible credit behavior, such as keeping your accounts active and never exceeding your credit limit, can positively impact your creditworthiness.

Importance of consistent credit management

It is important to note that improving your credit score is not a quick fix, but rather a gradual process that requires dedication and patience. By consistently managing your credit obligations, you can demonstrate to lenders and creditors that you are a responsible borrower.

Remember, your credit score is a reflection of your financial health and can impact your ability to secure loans, qualify for favorable interest rates, and even potentially affect your job prospects. By prioritizing good credit habits and employing these smart tips, you can work towards achieving a higher credit score and enjoying the many benefits that come with it.

So, take control of your credit future today and start implementing these smart tips. With discipline and determination, you can improve your credit score, open doors to new opportunities, and build a strong financial foundation.