Introduction

Welcome! In this post, I want to discuss the benefits of using Affirm to boost your credit score. Affirm is an innovative financial service that allows you to make purchases and pay over time, and it offers several advantages when it comes to improving your creditworthiness.

What is Affirm?

Affirm is a lending platform that offers transparent and flexible financing options for consumers. It provides an alternative to traditional credit cards and personal loans, and it is becoming increasingly popular among those looking to build or rebuild their credit history.

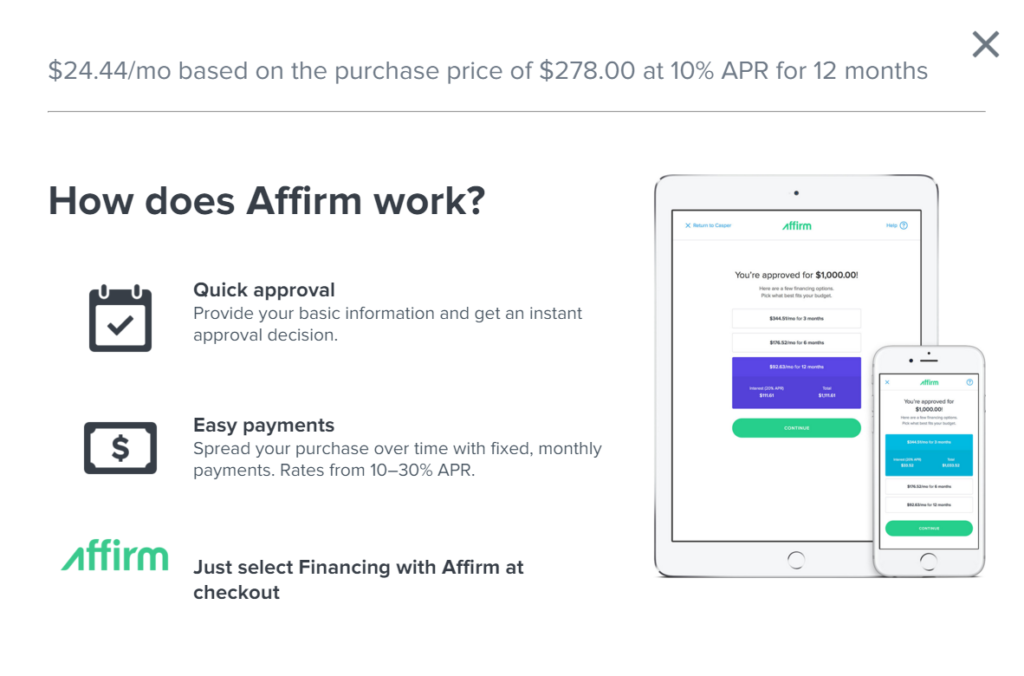

How Affirm Works

When you shop with Affirm, you have the option to pay for your purchases in fixed monthly installments, rather than paying the full amount upfront. This can help you manage your budget more effectively and avoid accumulating high-interest debt. Affirm reports your repayment history to major credit bureaus, which means that responsible use of the platform can have a positive impact on your credit score.

By using Affirm responsibly and making timely repayments, you can demonstrate to lenders that you are a reliable borrower. This can increase your chances of being approved for future credit applications and may also result in lower interest rates.

Affirm’s user-friendly interface and transparent terms make it a convenient and accessible option for anyone looking to improve their credit score. Remember, responsible use is key!

Understanding Credit Scores

What is a Credit Score?

A credit score is a three-digit number that represents an individual’s creditworthiness and financial health. It is a crucial factor that lenders use to determine whether you qualify for credit cards, loans, or mortgages. Credit scores range from 300 to 850, with higher scores indicating lower credit risk and better borrowing opportunities.

Importance of Credit Scores

Having a good credit score is advantageous in various ways. It allows you to access loans at lower interest rates, obtain higher credit limits, and secure better terms on mortgages. The benefits are not limited to borrowing alone; a good credit score can also positively impact your day-to-day life. It can help you secure lower insurance premiums, negotiate better utility rates, and even improve your chances of getting hired for certain jobs.

One effective method to boost your credit score is by using Affirm, a popular platform that offers financing options for online purchases. Affirm enables you to make timely payments on your purchases, which can significantly contribute to improving your credit score. By maintaining a positive payment history, you demonstrate your reliability and financial responsibility, thereby enhancing your creditworthiness in the eyes of lenders.

understanding credit scores and their importance is crucial for anyone aiming to improve their financial well-being. By actively utilizing tools like Affirm to make regular, on-time payments, you can positively impact your credit score and unlock the benefits of a stronger credit profile.

Credit Score Factors

When it comes to our credit scores, many of us are constantly searching for ways to boost them. One tool that has gained popularity in recent years is Affirm. This platform not only offers convenient financing options, but it can actually help improve your credit score.

Payment History

One of the most important factors that lenders consider when determining our creditworthiness is our payment history. With Affirm, you can make your payments on time and build a positive payment history. This can greatly improve your credit score over time.

Credit Utilization

Another key factor is credit utilization, which refers to how much of your available credit you are using. Affirm reports your credit utilization to the credit bureaus, allowing you to demonstrate responsible credit management. By keeping your utilization low and making timely payments, you can increase your credit score.

Length of Credit History

The length of your credit history also plays a role in your credit score. Affirm helps by reporting your payment history, thus establishing a longer credit history. This can have a positive impact on your credit score.

Credit Mix

Having a healthy mix of different types of credit accounts can also boost your credit score. Affirm allows you to diversify your credit profile and show lenders that you can manage different types of credit responsibly.

New Credit

Finally, opening new credit accounts can also improve your credit score. By using Affirm, you can add a new credit account to your credit profile, which can have a positive impact on your credit score.

utilizing Affirm can have numerous benefits when it comes to boosting your credit score. With its ability to positively impact payment history, credit utilization, length of credit history, credit mix, and new credit, it is a valuable tool for anyone looking to improve their creditworthiness and financial standing.

How Affirm Boosts Your Credit Score

Reporting to Credit Bureaus

When it comes to improving my credit score, I have found that using Affirm has been incredibly beneficial. One of the key ways that Affirm helps to boost my credit score is through its reporting to credit bureaus. This means that every time I make a payment on my Affirm loan, it is reported to the major credit bureaus. This is important because it allows me to establish a positive payment history, which is a crucial factor in determining my creditworthiness.

Positive Payment History

One of the most significant benefits of using Affirm is that it enables me to build a positive payment history. Each time I make a payment on time, it shows financial responsibility and demonstrates to lenders that I am reliable when it comes to repaying my debts. This can help me qualify for better loan terms and lower interest rates in the future.

Increased Credit Limit

Another advantage of utilizing Affirm is the potential to increase my credit limit. As I continue to make timely payments on my Affirm loans, I may be eligible for a credit limit increase. This allows me to have more buying power and can positively impact my credit utilization ratio, another key factor in determining my credit score.

using Affirm has numerous benefits when it comes to boosting my credit score. Through their reporting to credit bureaus, establishment of a positive payment history, and potential for increased credit limits, Affirm has been a valuable tool in my credit-building journey.

Benefits of Using Affirm

Improved Financial Health

If you’re looking to boost your credit score, using Affirm can be a game-changer. Affirm offers a unique way to finance your purchases without impacting your credit score negatively. By using Affirm responsibly, you can demonstrate your ability to make timely payments, which is a crucial factor in building a strong credit history. This, in turn, can lead to an improved credit score and better financial health overall.

Increased Credit Opportunities

Affirm’s innovative financing options provide you with more opportunities to establish and build your credit. Whether you’re making a major purchase or shopping for everyday essentials, using Affirm allows you to take advantage of online stores that accept this payment method. With each successful repayment, you not only improve your creditworthiness but also open the door to potentially higher credit limits and better loan terms in the future.

Building Credit Without a Credit Card

Don’t have a credit card? No problem. Affirm offers you a way to start building credit without the need for a traditional credit card. Instead, you can make purchases and finance them through Affirm, which reports your payment activity to major credit bureaus. This means you can establish a positive credit history even without a credit card, setting yourself up for future credit opportunities.

using Affirm can have numerous benefits for your credit score and overall financial well-being. By using Affirm responsibly, you can improve your financial health, increase your credit opportunities, and even build credit without the need for a credit card. So why wait? Start using Affirm today and take control of your credit journey.

Affirm vs. Traditional Credit Cards

When it comes to boosting your credit score, Affirm offers several unique benefits that set it apart from traditional credit cards. Unlike credit cards, Affirm does not require a hard inquiry on your credit report when you apply for financing. This means that your credit score remains unaffected, allowing you to explore your options without worrying about potential damage to your credit.

Another advantage of using Affirm to boost your credit score is the ability to take advantage of interest-free financing. Unlike traditional credit cards, which often come with high interest rates, Affirm offers the opportunity to finance your purchases without accruing any interest. This can save you a significant amount of money in the long run and help you pay off your debts faster.

Additionally, Affirm eliminates the burden of annual fees or hidden costs. Many credit cards charge annual fees or surprise you with hidden charges, but with Affirm, you can confidently make your purchases without the worry of unexpected costs. This transparency and simplicity make Affirm an attractive option for those looking to improve their credit score.

Affirm provides a convenient and affordable way to boost your credit score. With no hard inquiries on your credit report, interest-free financing, and no annual fees or hidden costs, Affirm offers a user-friendly and beneficial alternative to traditional credit cards. So why wait? Start using Affirm today and watch your credit score soar!

Tips for Using Affirm Responsibly

Using Affirm can be a great way to boost your credit score and improve your financial health. However, like any credit service, it’s important to use Affirm responsibly to avoid potential pitfalls. Here are some tips to help you make the most of Affirm while protecting your credit score.

Pay On Time

One of the most crucial aspects of using Affirm responsibly is to always pay your monthly installments on time. Late payments can have a negative impact on your credit score and may result in additional fees or penalties. By making timely payments, you demonstrate your reliability as a borrower and improve your creditworthiness.

Avoid Overspending

While it can be tempting to take advantage of Affirm’s flexible payment options, it’s important to resist overspending. Before making a purchase, carefully consider your budget and ensure you can comfortably afford the monthly payments. By avoiding excessive debt, you can maintain a manageable credit utilization ratio and improve your credit score over time.

Monitor Your Credit Score

Keep a close eye on your credit score while using Affirm. Regularly reviewing your credit report can help you identify any errors or discrepancies that might negatively impact your score. By staying vigilant, you can address any issues promptly and protect your creditworthiness.

By following these tips, you can use Affirm responsibly and enjoy the benefits of improved credit score and financial well-being. Start using Affirm today and take control of your credit journey!

Conclusion

In conclusion, using Affirm to boost your credit score can provide numerous benefits and help you achieve your financial goals. By using Affirm responsibly and making timely payments, you can improve your creditworthiness and increase your chances of qualifying for future loans and credit cards with favorable terms.

Summary of Benefits

The primary benefit of using Affirm is its ability to help you build and improve your credit score. Affirm reports your payment history to major credit bureaus, which allows you to establish a positive credit history. By consistently making on-time payments, you demonstrate your creditworthiness and responsibility to potential lenders. As a result, you may be eligible for higher credit limits, lower interest rates, and more favorable loan terms in the future.

Another advantage of using Affirm is its ease of use and convenience. The app provides a user-friendly interface, allowing you to track your payments, view your credit limit, and manage your account seamlessly. The ability to split purchases into smaller, more manageable payments also helps to avoid overspending and stay on top of your finances.

Final Thoughts

While Affirm can be a beneficial tool for boosting your credit score, it’s important to remember that responsible credit management is key. Make sure to only borrow what you can comfortably afford to repay, and always make your payments on time. By using Affirm responsibly, you can take control of your credit score and pave the way towards a brighter financial future.