Introduction

Welcome to my post on tips and tricks for boosting your credit score! Your credit score plays a crucial role in your financial life, influencing your ability to secure loans, rent an apartment, or even get a job. Understanding how to raise your credit score is essential for financial success.

Understanding the Importance of Credit Score

Your credit score is a numerical representation of your creditworthiness, based on your credit history. Lenders, landlords, and employers use this score to assess your financial reliability and responsibility. A higher credit score signifies lower risk, making you more likely to be approved for loans and receive favorable interest rates.

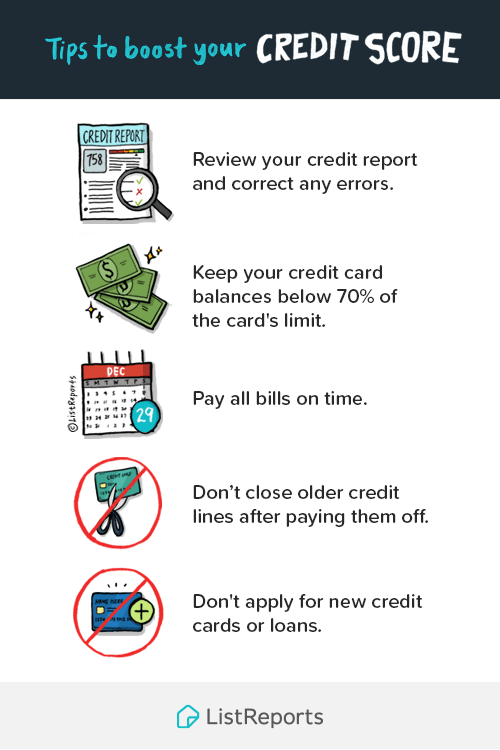

To improve your credit score, focus on the following factors:

- Payment History: Consistently making on-time payments is essential. Late payments can have a negative impact on your credit score.

- Credit Utilization: Keep your credit utilization ratio below 30%. This means using only up to 30% of your available credit.

- Credit Mix: Maintain a healthy mix of different types of credit, such as credit cards, loans, and mortgages.

- Length of Credit History: The longer your credit history, the better. Avoid closing old accounts, as they contribute to the average age of your accounts.

By implementing these tips, you can gradually improve your credit score and enhance your financial opportunities. Remember, responsible financial habits are essential for long-term success.

Tips and Tricks for Boosting Your Credit Score

1. Develop Good Financial Habits

As someone striving to improve my credit score, I understand the importance of developing good financial habits. The key to successfully boosting your credit score lies in consistently making responsible financial decisions.

Creating a Budget and Sticking to It

One effective way to improve your credit score is by creating a detailed budget and sticking to it religiously. This allows you to carefully track your expenses and ensure that you are not overspending. By identifying unnecessary expenditures and reallocating funds towards debt payments or savings, you can gradually improve your creditworthiness.

Paying Bills on Time

Paying bills on time is a crucial factor that can significantly impact your credit score. Late payments can lead to negative marks on your credit report, which can be detrimental to your overall score. To avoid this, set up automatic payment reminders, utilize online banking, or consider setting up automatic bill payments to ensure you never miss a due date.

Reducing Credit Card Debt

High credit card balances relative to your credit limit can negatively affect your credit score. Aim to keep your credit card balances below 30% of your credit limit to demonstrate responsible credit utilization. Consider paying more than the minimum payment each month to reduce your outstanding balance and gradually lower your credit utilization ratio.

By adopting these good financial habits, you can make significant strides in improving your credit score. Remember, consistency and discipline are key when it comes to building a strong credit profile. So start implementing these tips today to enhance your creditworthiness and pave the way for a brighter financial future.

2. Monitor Your Credit Report Regularly

Requesting a Free Copy of Your Credit Report

One of the most effective ways to boost your credit score is by monitoring your credit report regularly. To do this, start by requesting a free copy of your credit report from the three major credit bureaus – Equifax, Experian, and TransUnion. By law, you are entitled to one free copy of your credit report from each bureau every year. Reviewing your credit report will allow you to identify any errors or discrepancies that may be negatively impacting your score.

Checking for Errors and Disputing Them

Once you have obtained your credit report, carefully review it for any errors, such as late payments or accounts that do not belong to you. If you notice any inaccuracies, it is essential to dispute them promptly. Each credit bureau has a dispute process that allows you to challenge any incorrect information on your report. Be sure to provide supporting documents and a detailed explanation of why the information is inaccurate.

Identifying and Addressing Negative Factors

In addition to reviewing for errors, it is important to identify and address any negative factors impacting your credit score. Look for late payments, high credit card balances, or accounts in collections. Developing a plan to tackle these negative factors, such as creating a budget to pay down debt or negotiating payment plans with creditors, can significantly improve your creditworthiness.

Monitoring your credit report regularly and taking necessary steps to correct errors and address negative factors will go a long way in boosting your credit score. Stay proactive and committed to maintaining a good credit history, and you will see positive results over time.

3. Maintain a Low Credit Utilization Ratio

Having a low credit utilization ratio is crucial for boosting your credit score. This ratio refers to the percentage of your available credit that you are currently using. Understanding and managing this ratio can greatly impact your creditworthiness.

Understanding Credit Utilization Ratio

Credit utilization ratio is calculated by dividing the total credit you are using by your total available credit limit. For example, if you have a credit limit of $10,000 and you currently owe $2,000, your credit utilization ratio is 20%. A lower ratio indicates that you are effectively managing your credit.

Keeping Credit Card Balances Low

To maintain a low credit utilization ratio, it’s vital to keep your credit card balances low. Pay off your credit cards in full each month or aim to keep the balances below 30% of the available credit limit. This demonstrates responsible credit usage to potential lenders and positively impacts your credit score.

Avoiding Opening Too Many Credit Accounts

Opening multiple credit accounts within a short span of time can negatively affect your credit utilization ratio. Each new account lowers your average account age and increases the amount of credit available to you. This can lead to a higher credit utilization ratio if you start utilizing more credit. Be strategic and thoughtful when considering new credit accounts.

By maintaining a low credit utilization ratio, keeping credit card balances low, and avoiding opening too many credit accounts, you can boost your credit score and improve your financial standing. So, take control of your credit utilization, and watch your credit score soar!

4. Build a Solid Credit History

Building a solid credit history is crucial for boosting your credit score. Lenders use your credit history to assess your creditworthiness and determine whether to approve your applications for loans, credit cards, or mortgages. Here are three effective strategies to establish and maintain a strong credit history.

Opening a Secured Credit Card

If you have a limited credit history or a low credit score, opening a secured credit card can be a great option. Secured credit cards require a cash deposit that serves as collateral, minimizing the risk for the credit card issuer. By using a secured credit card responsibly and making timely payments, you can demonstrate your ability to manage credit effectively and build a positive credit history.

Becoming an Authorized User

Another way to boost your credit score is by becoming an authorized user on someone else’s credit card account. This strategy works well if the primary account holder has a long and positive credit history. As an authorized user, the primary account holder’s account activity will be reported on your credit report, helping to improve your credit score.

Making Timely Payments

Consistently making your payments on time is one of the most important factors in building a solid credit history. Late payments can severely damage your credit score, so it’s essential to pay your bills by the due dates. Consider setting reminders, enrolling in automatic payments, or creating a budget to ensure you can make timely payments every month.

By implementing these strategies and actively managing your credit, you can establish a strong credit history and improve your credit score over time. Remember, building good credit takes time and patience, so stay committed to your financial goals and make responsible credit decisions.

5. Diversify Your Credit Mix

When it comes to boosting your credit score, it’s not just about paying your bills on time and keeping your credit utilization low. Another crucial factor that can positively impact your score is the diversity of your credit mix. By understanding the importance of credit mix, using different types of credit responsibly, and avoiding overextending yourself, you can give your credit score a healthy boost.

Lenders like to see a healthy mix of different types of credit in your history. This shows that you can handle different forms of credit responsibly. Having a mix of credit cards, loans, and lines of credit demonstrates your ability to manage different financial obligations.

Using Different Types of Credit Responsibly

It’s essential to use different types of credit responsibly to improve your credit score. Make sure to make your payments on time and keep your balances low. When you have different types of credit, it’s crucial to manage each one effectively and avoid maxing out your limits.

Avoiding Overextending Your Credit

While it’s important to have a diverse credit mix, it’s equally crucial not to overextend yourself financially. Taking on too much credit can lead to higher debt levels, which can negatively impact your credit score. It’s important to borrow only what you need and can comfortably repay.

By diversifying your credit mix, understanding the importance of credit mix, using different types of credit responsibly, and avoiding overextending yourself, you can significantly improve your credit score and enhance your financial well-being. Make sure to take these tips into account as you work towards building and maintaining a strong credit history.

6. Avoid Closing Old Credit Accounts

The Potential Negative Impact of Closing Accounts

Closing old credit accounts can have a negative impact on your credit score. This is because the length of your credit history plays a significant role in determining your creditworthiness. When you close an old account, you are essentially shortening your credit history, which can lower your overall credit score.

Keeping Older Accounts Active

It is important to keep older credit accounts active to maintain a good credit score. Even if you no longer use a particular credit card, keeping the account open can help you demonstrate a long and consistent credit history. This is especially important if you have a good payment history associated with that account.

Closing Unused Accounts Strategically

While it’s generally advisable to keep old credit accounts open, there are situations where closing unused accounts can be beneficial. For example, if you have accounts with high annual fees or accounts that you no longer use but have a high credit limit, closing these accounts strategically can help improve your credit utilization ratio. However, it’s crucial to carefully consider the potential impact before making this decision.

By understanding the potential negative impact of closing old credit accounts, keeping older accounts active, and closing unused accounts strategically, you can make informed decisions to boost your credit score. Remember, maintaining a healthy credit score is important for your financial future.

Conclusion

Taking Control of Your Credit Score

In conclusion, improving your credit score is an essential step towards achieving financial success. With a positive credit score, you have access to better loan terms, lower interest rates, and increased financial opportunities. Throughout this article, I have provided you with valuable tips and tricks that can help you boost your credit score.

Firstly, it is crucial to regularly monitor your credit report and identify any errors or discrepancies. By disputing these inaccuracies and ensuring they are corrected, you can prevent them from negatively impacting your credit score. Additionally, paying your bills on time is essential for maintaining a good credit standing. Set up automatic payments or create reminders to ensure you never miss a payment deadline.

Furthermore, keeping your credit utilization ratio low can significantly improve your credit score. Try to keep your credit card balances below 30% of their limits to demonstrate responsible credit management. Lastly, avoid opening multiple new accounts within a short period, as this can raise red flags and lower your score.

By following these tips and tricks, you can take control of your credit score and pave the way for a brighter financial future. Remember, building a solid credit history takes time and patience, but the rewards are worth it. So start implementing these strategies today and watch your credit score soar!