Introduction

Medical debt can have a significant impact on your credit score, potentially affecting your financial stability and future borrowing opportunities. In this article, we will explore how medical debt affects your credit, the importance of your credit score, and the definition of medical debt.

Definition of Medical Debt

Medical debt refers to the amount of money owed to healthcare providers, such as doctors, hospitals, or clinics, for medical services received. This debt can arise from various medical expenses, including doctor visits, hospital stays, surgeries, prescription medications, or medical equipment.

Importance of Credit Score

Your credit score is a numerical representation of your creditworthiness, indicating your ability to borrow money and manage your financial obligations. Lenders, landlords, and even potential employers often rely on credit scores to make decisions about extending credit, approving rental applications, or hiring candidates.

How Medical Debt Affects Credit Score

When medical debt is not promptly paid off or goes into collections, it can negatively impact your credit score. Late payments, collection accounts, and judgments associated with medical debt can stay on your credit report for up to seven years. These negative marks can lower your credit score, making it more challenging to obtain credit at favorable terms and potentially leading to higher interest rates or loan denials.

it is crucial to understand how medical debt can affect your credit score. By promptly addressing medical bills and exploring potential repayment options, you can mitigate the negative impact on your credit and maintain financial stability.

Factors Impacting Credit Score

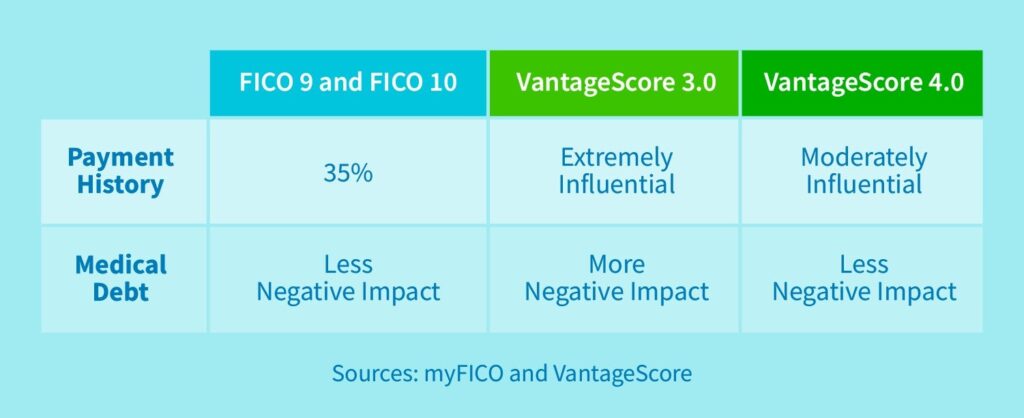

Payment History

One of the significant factors that influence your credit score is your payment history. This includes both medical and non-medical debts. Late payments, defaults, or accounts that have been sent to collections can have a negative impact on your credit rating. If you have a history of unpaid medical bills, it can result in a lower credit score, making it challenging to get approval for future loans or credit cards.

Credit Utilization Ratio

Another crucial factor in determining your credit score is your credit utilization ratio. This ratio compares the amount of credit you are currently using to the total credit available to you. Accumulating high medical debt can increase your credit utilization ratio, potentially lowering your credit score. It is essential to manage your medical bills carefully and avoid maxing out your credit lines.

Length of Credit History

The length of your credit history also affects your credit score. If you have a long credit history with on-time payments, it can positively impact your score. However, medical debt, especially when unpaid for an extended period, can negatively affect your credit history. It is crucial to address and resolve any outstanding medical debts promptly.

Credit Mix

Having a diverse credit mix, including credit cards, mortgages, and loans, can positively impact your credit score. However, medical debt alone may not provide the same benefit. It is essential to have a well-rounded mix of credit types to build and maintain a strong credit profile.

New Credit Inquiries

Finally, applying for and opening new credit accounts, including medical loans or credit cards, can impact your credit score. Multiple inquiries within a short period can indicate financial stress and may be considered a risk for lenders. It is important to be mindful of the potential impact of new credit inquiries on your credit score.

Understanding these factors is crucial in managing your medical debt and maintaining a healthy credit score. By staying proactive and addressing unpaid medical bills promptly, you can protect your creditworthiness and have better financial opportunities in the future.

Specifics of Medical Debt

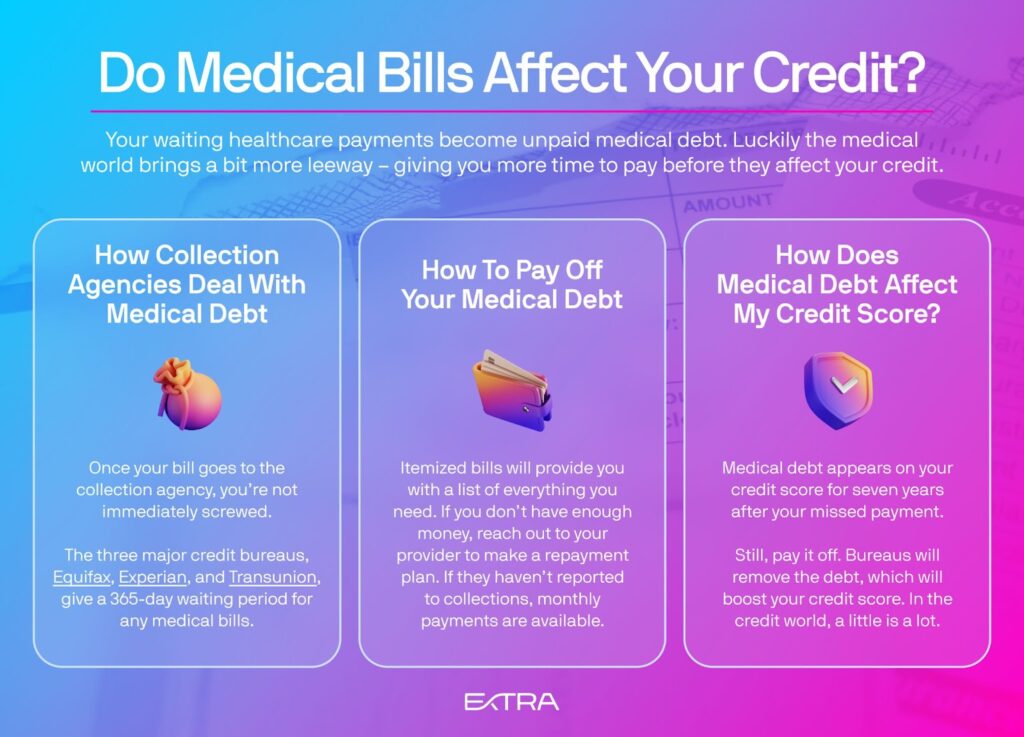

Medical Debt as a Delinquent Account

One aspect of medical debt that often confuses individuals is its classification as a delinquent account. Unlike other types of debts, medical bills are typically not reported as delinquent until they are significantly past due. This means that even if you are late paying a medical bill, it may not immediately impact your credit score. However, it is important to note that once a medical debt is reported as delinquent, it can have a major negative impact on your credit.

Credit Reporting of Medical Debt

When it comes to credit reporting, medical debt is handled differently from other types of debt. In 2017, changes were made to the credit reporting system that allowed for a 180-day waiting period before medical debts could be reported to credit bureaus. This means that if you pay your medical debt within that timeframe, it will not be reported on your credit report. However, if the debt remains unpaid for more than 180 days, it can have a detrimental impact on your credit score.

Influence of Medical Debt on Credit Reports

Medical debt, whether paid or unpaid, can have a significant influence on your credit report. Unpaid medical bills can decrease your credit score, making it more difficult for you to obtain credit in the future. Additionally, even if you pay off your medical debt, it can still remain on your credit report for up to seven years. This means that medical debt can continue to impact your credit worthiness long after it has been resolved.

By understanding the specifics of medical debt and its impact on your credit, you can make informed decisions about how to manage your healthcare expenses and maintain a healthy credit score. It is important to stay proactive in managing your medical debt to minimize its negative impact on your financial well-being.

Credit Score Calculation

Calculation Methodologies

When it comes to calculating your credit score, there are several methodologies that credit bureaus use to determine your financial health. These methodologies take into account various factors such as payment history, debt utilization, length of credit history, and types of credit accounts.

Weightage of Medical Debt in Calculation

Medical debt is just one of the factors that can impact your credit score. While it’s not the dominant factor, it still carries weight in the calculation. When determining your credit score, credit bureaus consider the amount of medical debt you owe, how recent the debt is, and whether it has been paid off or is in collections.

Credit Score Impact Scale

The impact of medical debt on your credit score can range from minimal to severe. Depending on your individual circumstances, it could cause a slight dip in your score or result in a significant decrease.

Severity Levels of Medical Debt on Credit Score

The severity of the impact varies depending on the amount of medical debt, the number of medical debts, and how they are being managed. If you have a small amount of medical debt that is being properly managed, its impact on your credit score may be minimal. However, if you have large amounts of unpaid medical debt or multiple medical collections, it can have a more severe impact on your credit score.

Understanding how medical debt affects your credit score is crucial in managing your overall financial health. It’s important to stay informed and take proactive steps to resolve any medical debt issues, as it can have long-lasting consequences on your creditworthiness.

Effects of Medical Debt

Medical debt can have a significant impact on your credit score and overall financial well-being. It is crucial to understand how medical debt affects your credit in order to make informed decisions and take necessary steps to mitigate its negative consequences.

Increased Risk of Credit Denial

Unpaid medical bills can lead to a higher risk of credit denial. When creditors review your credit history, they consider outstanding medical debt as a sign of financial instability. This may affect your ability to obtain loans or credit cards in the future.

Negative Impact on Loan and Credit Card Applications

Medical debt can also have a negative impact on your loan and credit card applications. Lenders and credit card issuers review your credit history to assess your creditworthiness. If you have a substantial amount of unpaid medical debt, they may perceive you as a higher risk borrower, leading to rejections of your applications.

Potential Increase in Interest Rates

Even if you are eligible for a loan or credit card, medical debt can result in higher interest rates. Lenders may justify this by considering your medical debt as an indicator of financial instability, thereby charging you additional interest to mitigate their perceived risk.

Limited Access to Better Credit Offers

Having medical debt can limit your access to better credit offers such as lower interest rates, higher credit limits, or attractive rewards programs. Lenders may view your medical debt as a risk factor, making it more challenging to qualify for more favorable credit options.

Difficulty in Renting Accommodations

Beyond loan and credit card applications, medical debt can also affect your ability to rent accommodations. Landlords often request credit checks to evaluate potential tenants. With unpaid medical debt, your credit score may suffer, making it harder to secure a rental agreement.

Understanding the effects of medical debt on your credit will empower you to take proactive steps towards managing your financial situation responsibly. By addressing and resolving medical debt promptly, you can improve your creditworthiness and secure a brighter financial future.

Strategies to Manage Medical Debt

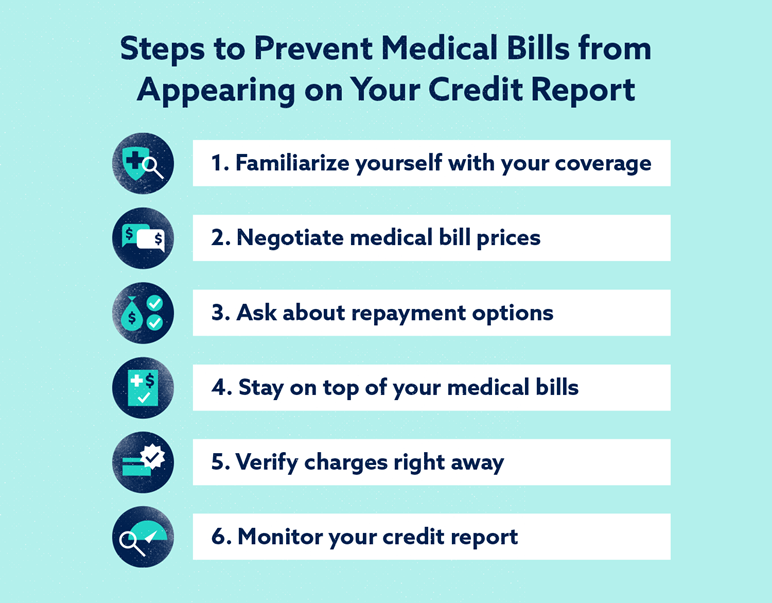

Contacting Medical Providers and Insurance Companies

When facing medical debt, it is essential to reach out to your medical providers and insurance companies to ensure that there are no errors or discrepancies in your bills. Contact your healthcare providers to obtain a detailed breakdown of the charges and verify that they align with the services you received. Additionally, communicate with your insurance company to confirm that the claims have been processed correctly. Resolving any billing errors promptly can prevent negative impacts on your credit.

Negotiating and Managing Medical Bills

If you are struggling to pay your medical bills, don’t hesitate to negotiate with your healthcare providers. Many medical facilities offer financial assistance programs or discounts for low-income individuals. It is worth exploring these options to alleviate the burden of excessive medical debt. Furthermore, discuss a manageable payment plan with your provider to avoid delinquency and ensure that your bills are paid on time.

Exploring Financial Assistance Programs

In some cases, financial assistance programs may be available to help individuals facing overwhelming medical debt. Research local and national resources to find potential programs that can assist with medical expenses. These programs often have specific eligibility criteria, so it’s important to thoroughly understand the requirements and apply accordingly.

Setting up Payment Plans

If you are unable to pay your medical bills in full, setting up a payment plan can be a beneficial option. Contact your medical provider to discuss a payment arrangement that fits within your budget. By making regular payments, you can avoid the negative consequences associated with delinquent medical debt.

Considering Debt Consolidation or Settlement Options

For individuals with multiple sources of medical debt, debt consolidation or settlement options may be worth considering. Debt consolidation involves combining several debts into one loan with a lower interest rate, while debt settlement entails negotiating with creditors to reduce the total amount owed. These strategies can help simplify your financial situation and potentially save you money in the long run.

By following these strategies, you can effectively manage your medical debt and minimize its impact on your credit. It’s crucial to take proactive steps to ensure your financial stability and protect your creditworthiness. Remember, help is available, so don’t hesitate to seek assistance if you’re facing significant medical debt.

Prevention and Minimization of Medical Debt

Medical debt can have a significant impact on your credit score, potentially affecting your ability to secure loans or credit in the future. However, taking proactive steps to prevent and minimize medical debt can help protect your credit and financial well-being.

Maintaining Health Insurance Coverage

One of the most effective ways to prevent overwhelming medical debt is to maintain adequate health insurance coverage. By staying insured, you can reduce your out-of-pocket expenses and ensure that insurance covers a significant portion of your medical bills.

Understanding Insurance Policies and Coverage Limits

To avoid unexpected medical expenses, it’s essential to understand the details of your insurance policy, including coverage limits, copayments, and deductibles. Familiarize yourself with the specific services or treatments covered, as well as any out-of-network limitations, to avoid costly surprises.

Making Timely Payments and Avoiding Delinquency

Paying your medical bills on time is crucial for maintaining a healthy credit score. Work with healthcare providers to establish manageable payment plans, if necessary, to avoid falling into delinquency.

Seeking and Utilizing Preventive Care Services

Taking advantage of preventive care services, such as regular check-ups and vaccinations, can help identify and address potential health issues before they become more severe and costly. By focusing on preventive care, you can reduce the likelihood of unexpected medical expenses and, ultimately, medical debt.

By following these proactive measures, you can significantly minimize the impact of medical debt on your credit score and ensure financial stability. Remember to stay informed, prioritize preventive care, and maintain open communication with your healthcare providers to safeguard your creditworthiness.

Conclusion

In conclusion, understanding how medical debt affects your credit is essential for maintaining a healthy financial standing. Addressing medical debt and its impact on your credit score is crucial to ensure long-term financial stability.

Importance of Addressing Medical Debt

By addressing medical debt, you can prevent it from negatively impacting your credit score. Medical debt can be challenging to manage, but it is important to prioritize paying off these debts to avoid any negative consequences. Ignoring medical bills can lead to collection accounts and ultimately damage your creditworthiness. Therefore, it is vital to actively manage and address medical debts promptly.

Long-term Impact on Credit Score

Medical debt can have a long-lasting impact on your credit score. Unpaid medical bills can be reported to credit bureaus, leading to a decrease in your credit score. These delinquent accounts can remain on your credit report for up to seven years, making it difficult to obtain loans, mortgages, or credit cards in the future. It is essential to prevent medical debt from accumulating and harming your creditworthiness.

Taking Control of Financial Health

To take control of your financial health, it is important to stay on top of medical bills and make timely payments. Establishing a payment plan with medical providers or negotiating a lower amount can help alleviate the burden of medical debt. It is also advisable to regularly monitor your credit report for any errors or discrepancies related to medical debt. Taking proactive steps to address medical debt will not only protect your credit score but also contribute to your overall financial well-being.