Introduction

Welcome to my friendly post on “The Impact of Credit Card Payments on Your Credit Score.” In this article, I will discuss the importance of credit scores, how they can be affected by credit card payments, and the factors that play a role in determining your credit score.

What is a credit score?

A credit score is a numerical representation of your creditworthiness. It is an evaluation of your credit history and helps lenders determine your ability to repay loans and manage credit responsibly. Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness.

Why is credit score important?

Your credit score is vital because it influences your ability to obtain credit, such as loans or credit cards, and affects the interest rates and terms you may be offered. Landlords, insurance companies, and even potential employers may also consider your credit score.

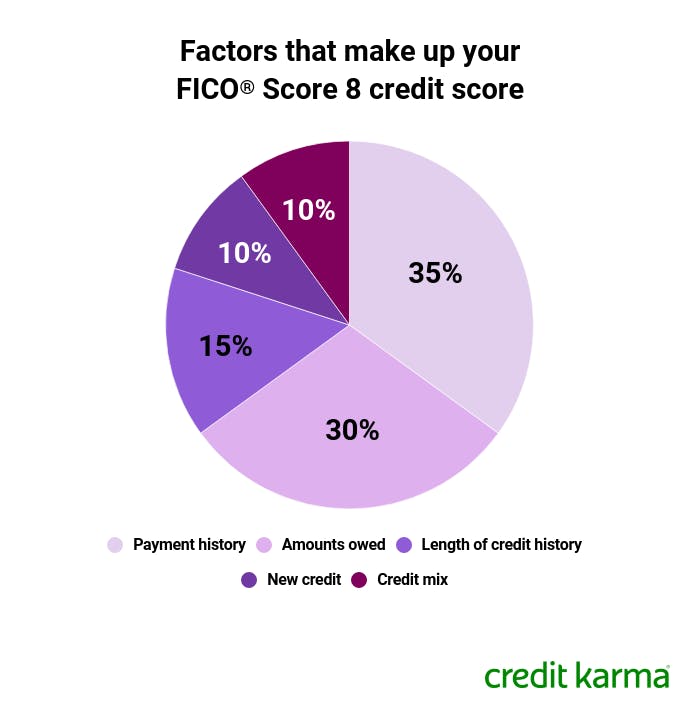

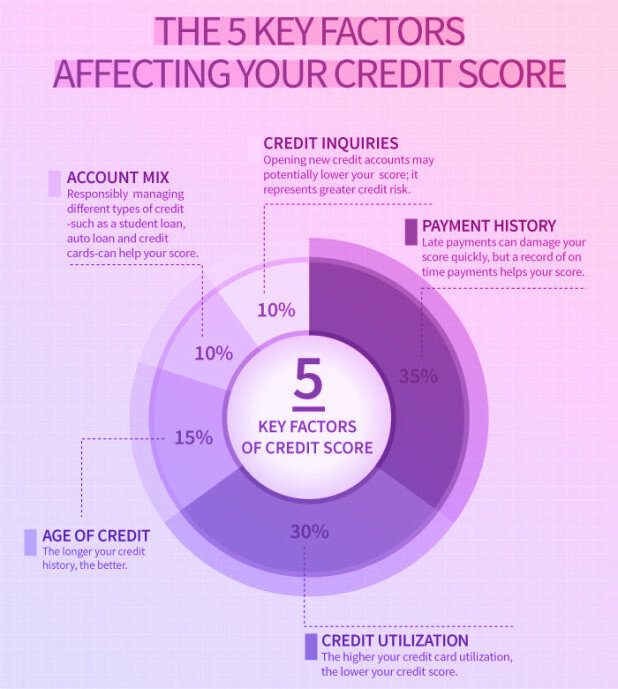

What factors affect credit score?

Several factors impact your credit score, including payment history, credit utilization, length of credit history, types of credit, and new credit applications. Making credit card payments on time and keeping your credit card balances low are crucial habits that can positively impact your credit score.

In the upcoming sections, we will explore these factors in more detail and discuss how credit card payments can help boost your credit score. So let’s dive in and explore the impact of credit card payments on your credit score!

Impact of Credit Card Payments

As someone who consistently uses credit cards for my purchases, I have always wondered about the effect of these payments on my credit score. After conducting thorough research, I have discovered some interesting facts that I would like to share.

How do credit card payments affect credit score?

Credit card payments play a crucial role in determining your credit score. It is important to understand that both positive and negative actions can influence your score. Let’s explore three key scenarios.

Effects of paying off credit card balance

When you pay off your credit card balance in full and on time, it has a significantly positive impact on your credit score. Timely payments demonstrate responsible financial behavior, which is highly regarded by credit bureaus. It shows that you are capable of managing your finances effectively and reduces your overall debt utilization ratio.

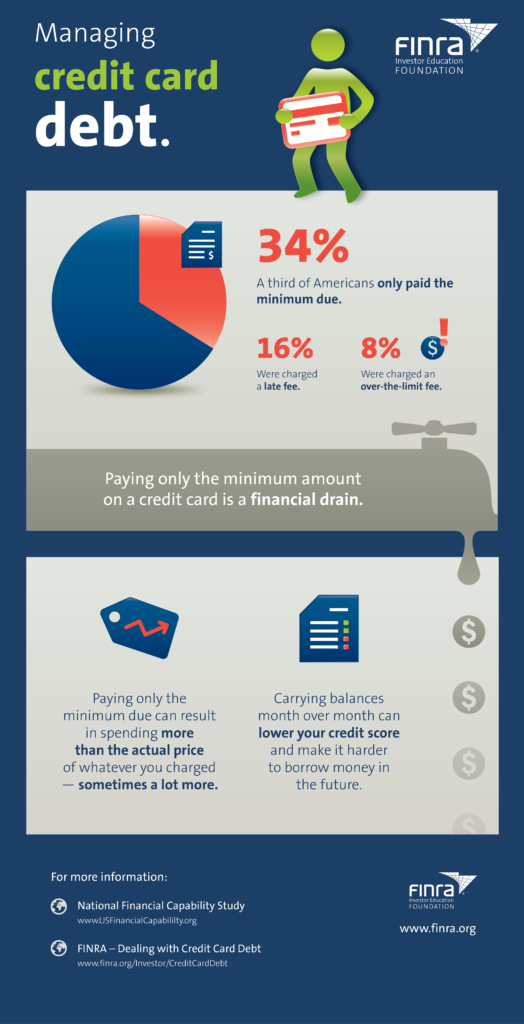

Effects of making minimum payments

Making only the minimum payments can have a neutral effect on your credit score. While it may not negatively impact your score, it is important to note that carrying a balance and paying only the minimum each month can result in high interest charges and a longer repayment period.

Effects of missing credit card payments

Missing credit card payments is detrimental to your credit score. It indicates financial instability and unreliable payment behavior. Late payments can stay on your credit report for up to seven years, impacting your future creditworthiness.

By understanding the impact of credit card payments on your credit score, you can make informed financial decisions. Remember, consistent and timely payments will help you build a strong credit history, leading to better opportunities in the future.

Credit Card Utilization

What is credit card utilization?

Credit card utilization refers to the percentage of your available credit that you are currently using. Let’s say you have a credit card with a limit of $10,000 and your outstanding balance is $2,000. In this case, your credit card utilization rate would be 20% ($2,000 divided by $10,000).

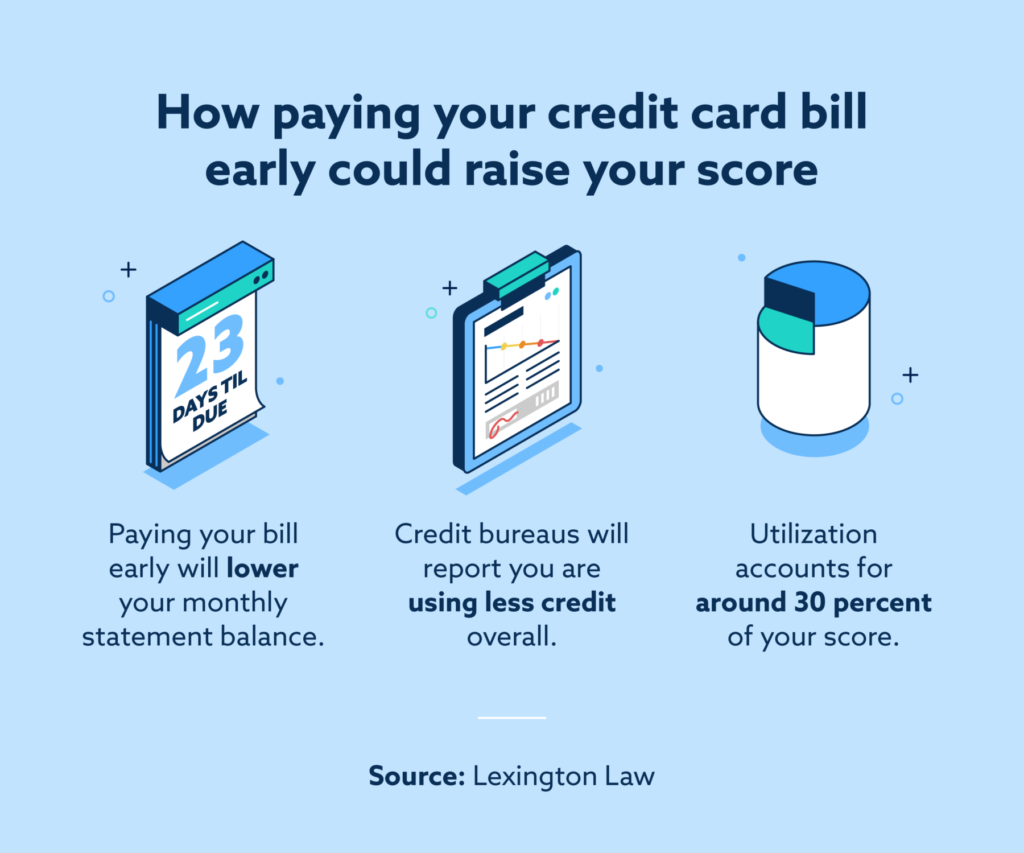

How does credit card utilization affect credit score?

Credit card utilization has a significant impact on your credit score. Lenders consider it as one of the key factors in determining your creditworthiness. Ideally, you should aim to keep your credit card utilization below 30% to maintain a good credit score. Higher utilization rates can indicate a higher risk of defaulting on payments.

Tips for managing credit card utilization

To manage your credit card utilization effectively, consider the following tips:

- Pay off your credit card balance in full each month if possible.

- Avoid maxing out your credit cards.

- Spread your spending across multiple credit cards to keep individual utilization rates low.

- Regularly monitor your credit card balances and make sure they are below the recommended 30% threshold.

By understanding credit card utilization and following these tips, you can positively impact your credit score and maintain a healthy financial profile. Remember, responsible credit card usage can lead to better opportunities and lower interest rates when it comes to borrowing in the future.

Credit Card Payment History

Having a good credit score is crucial for financial stability and future opportunities. Your credit score is an important factor that lenders consider when you apply for loans, mortgages, or other lines of credit. One aspect that greatly impacts your credit score is your credit card payment history.

Importance of payment history in credit score

Your payment history makes up a significant portion of your credit score. Paying your credit card bills on time shows lenders that you are responsible and can manage your debt effectively. On the other hand, missed or late payments can have a negative impact on your credit score, as it reflects a lack of financial responsibility.

How missed or late payments impact credit score

If you consistently miss payments or make late payments, it can significantly lower your credit score. This negative information can stay on your credit report for up to seven years, making it more difficult for you to access credit in the future. Late payments also often result in additional fees and increased interest rates, which can lead to a spiral of debt.

How on-time payments improve credit score

Making your credit card payments on time not only avoids damage to your credit score but also has a positive effect. Each on-time payment demonstrates your reliability as a borrower and improves your creditworthiness in the eyes of lenders. Regular, timely payments can help build a solid credit history, increase your credit score, and open doors to better financial opportunities.

Remember, developing a habit of making on-time credit card payments can have a lasting impact on your credit score, increasing your chances of securing favorable interest rates and loan terms in the future.

Debt-to-Income Ratio

What is debt-to-income ratio?

Debt-to-income ratio is a financial measure that compares the amount of debt you have to your overall income. It is calculated by dividing your total monthly debt payments by your gross monthly income. This ratio is a key factor that lenders consider when determining your creditworthiness.

How does debt-to-income ratio affect credit score?

Your debt-to-income ratio plays a crucial role in determining your credit score. A high ratio indicates that you are relying heavily on borrowed funds, leading to a higher credit risk. As a result, your credit score may be negatively affected. Lenders prefer borrowers with a lower debt-to-income ratio as it shows that you have a good balance between your income and debt obligations.

Strategies for maintaining a healthy debt-to-income ratio

To maintain a healthy debt-to-income ratio, it is important to manage your debts responsibly. Start by paying off high-interest debts first and avoid unnecessary borrowing. Additionally, aim to keep your credit card balances low and make timely payments to reduce your overall debt. It is also beneficial to monitor your credit report regularly to identify any errors or fraudulent activity.

maintaining a low debt-to-income ratio is essential for a healthy credit score. By effectively managing your debts and making responsible financial choices, you can positively impact your creditworthiness and improve your overall financial well-being.

Credit Limit and Available Credit

One important factor that can greatly impact your credit score is your credit limit and the amount of available credit you have. Understanding how these elements work is crucial for managing your credit card payments effectively.

What is credit limit?

Your credit limit refers to the maximum amount of money you can borrow on your credit card. It is determined by your credit card issuer based on various factors, such as your income, credit history, and creditworthiness. Essentially, it sets the boundary for how much you can charge on your card without incurring additional fees or penalties.

How credit limit affects credit score

Your credit limit has a direct influence on your credit score. A higher credit limit can improve your credit utilization ratio, which is the ratio of your outstanding credit card balances to your total available credit. Maintaining a low credit utilization ratio, typically below 30%, demonstrates responsible credit usage and can positively impact your credit score.

Why available credit is important for credit score

The amount of available credit you have plays a significant role in determining your creditworthiness. Lenders and credit agencies assess how much credit you have available versus how much you have already used. Having a larger amount of available credit suggests financial stability and responsibility, which can result in a higher credit score.

By understanding the relationship between your credit limit, available credit, and credit score, you can make informed decisions when it comes to managing your credit card payments. It is essential to keep your credit utilization ratio low by regularly paying off your balances and maximizing your available credit to positively impact your credit score.

Closing Credit Card Accounts

Effects of closing credit card accounts on credit score

Closing a credit card account can have an impact on your credit score, and it is important to understand how this decision can affect your financial standing. When you close a credit card account, it can potentially lower your credit score due to several factors.

Firstly, closing a credit card account reduces your available credit. This means that your overall credit utilization ratio may increase, since you now have less credit available to you. Credit utilization ratio is an important factor in determining your credit score, and a higher ratio can negatively impact your score.

Additionally, closing a credit card account can affect the length of your credit history. The length of your credit history is another factor that influences your credit score. By closing an account that you have had for a long time, you are essentially reducing the average age of your credit accounts, which can have a negative impact on your credit score.

When is it advisable to close a credit card account?

While the decision to close a credit card account should not be taken lightly, there are certain situations where it may be advisable. If the credit card has high fees or interest rates, and you have other credit cards that better suit your financial needs, closing the account can make sense. Similarly, if you find that you are tempted to overspend or you are struggling to manage multiple credit cards, closing one account may help simplify your financial situation.

However, it is important to consider the potential impact on your credit score before making the decision to close a credit card account. If you are unsure about how closing an account will affect your credit score, it may be helpful to consult with a financial advisor who can provide guidance based on your specific circumstances.

Remember, maintaining a good credit score is essential for your financial well-being, so it is important to make informed decisions when it comes to managing your credit cards.

Conclusion

After thoroughly discussing the impact of credit card payments on your credit score, it is evident that paying off your credit card balances can significantly improve your credit score. By consistently making on-time payments and reducing your credit card debt, you demonstrate responsibility and financial stability to lenders.

Summary of the impact of credit card payments on credit score

Paying off your credit card balances has a positive impact on your credit score in several ways. First, it helps lower your credit utilization ratio, which is a significant factor in determining your credit score. Additionally, consistently making on-time payments reflects positively on your credit history and builds trust with lenders. By paying off your credit card debt, you also reduce the risk of accumulating high interest charges, saving yourself money in the long run. These positive changes to your credit score can result in better loan terms, lower interest rates, and increased borrowing power.

Tips for improving credit score through credit card payments

To maximize the positive impact of credit card payments on your credit score, there are a few tips to keep in mind. First, strive to pay your credit card bills in full and on time each month. This demonstrates financial responsibility and safeguards against late payment penalties. Secondly, keeping your credit card balances low in relation to your credit limit can help lower your credit utilization ratio. Lastly, avoid opening too many credit card accounts, as this can have a negative impact on your credit score.

In conclusion, carefully managing your credit card payments can have a significant impact on your credit score. By paying off your balances in a timely manner and keeping your credit utilization low, you can improve your creditworthiness and gain access to better financial opportunities. Remember, maintaining a healthy credit score is an ongoing process that requires discipline and responsible financial habits.