Introduction

Over the years, the burden of average American debt has become a growing concern for many individuals and families across the nation. The accumulation of debt has reached unprecedented levels, impacting people from all walks of life. In this post, I aim to provide an overview of the American debt crisis and emphasize the importance of addressing this issue promptly.

Overview of the American debt crisis

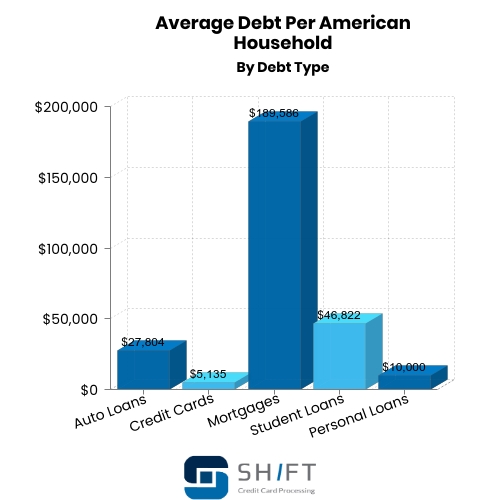

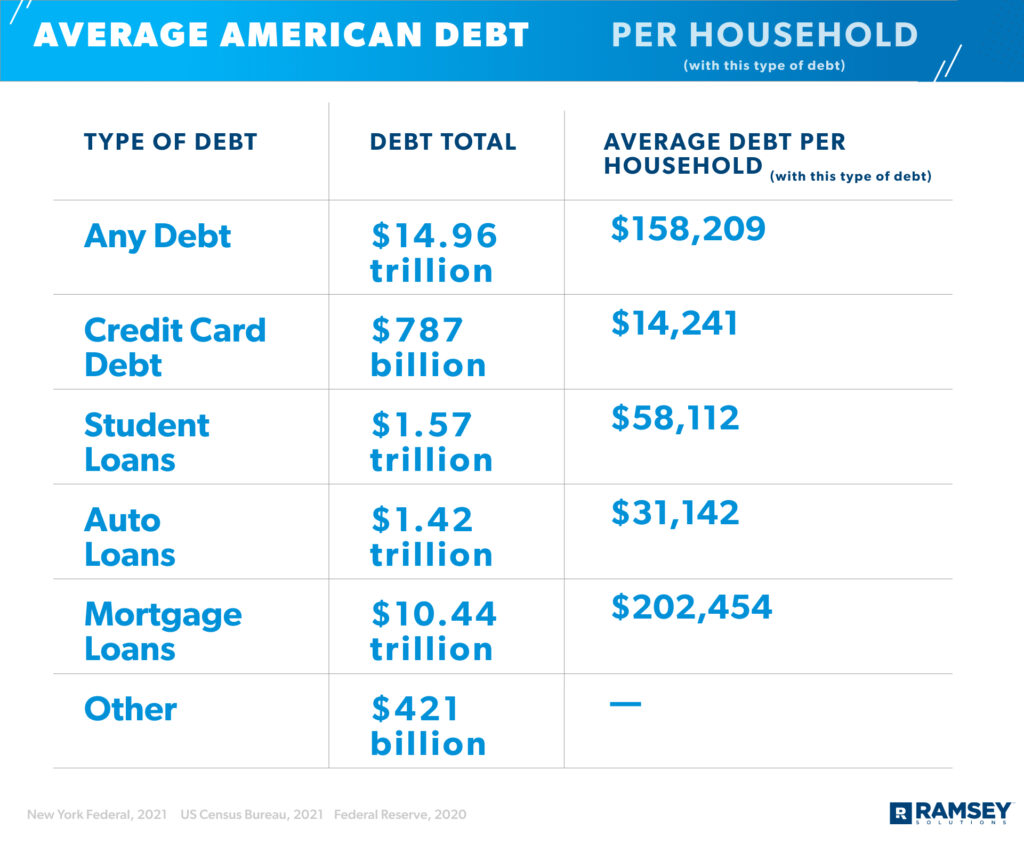

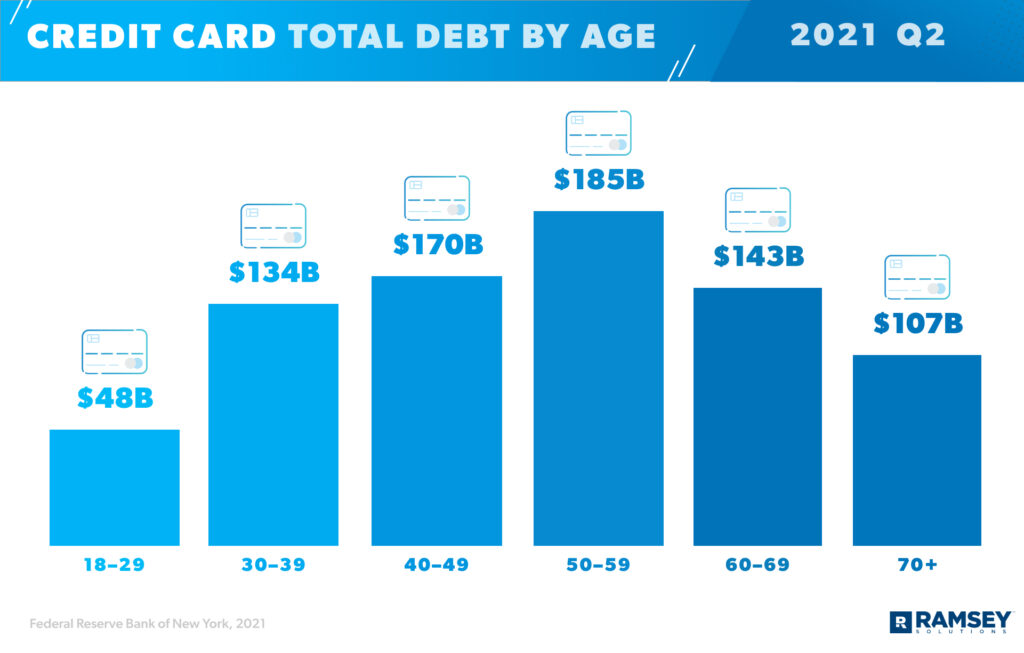

The average American debt consists of various types, including credit card debt, student loans, mortgages, and personal loans. Despite the different sources, the commonality is the financial strain it places on individuals. Many Americans find themselves living paycheck to paycheck, struggling to make ends meet due to the overwhelming amount of debt they have accumulated over time.

Importance of addressing the issue

Addressing the average American debt crisis is crucial for several reasons. Firstly, excessive debt leads to increased stress and anxiety among individuals, negatively impacting their mental and physical well-being. Additionally, it limits their ability to invest in their future and hampers economic growth at both the individual and national level. By tackling this burden, we can empower individuals to regain financial stability, enhance personal growth, and contribute to a stronger economy.

In the following sections, we will explore strategies to manage and reduce debt effectively. By implementing these strategies, individuals can take control of their financial situation and work towards a debt-free future. Let’s dive into the various tools and techniques that can help us overcome the burden of average American debt.

Understanding American Debt

Debt has become an all-too-common burden faced by the average American today. As a result of various factors, the levels of debt in the United States have reached unprecedented heights. In order to tackle this issue head-on, it is crucial to have a comprehensive understanding of the nature and contributing factors of average American debt.

Defining average debt

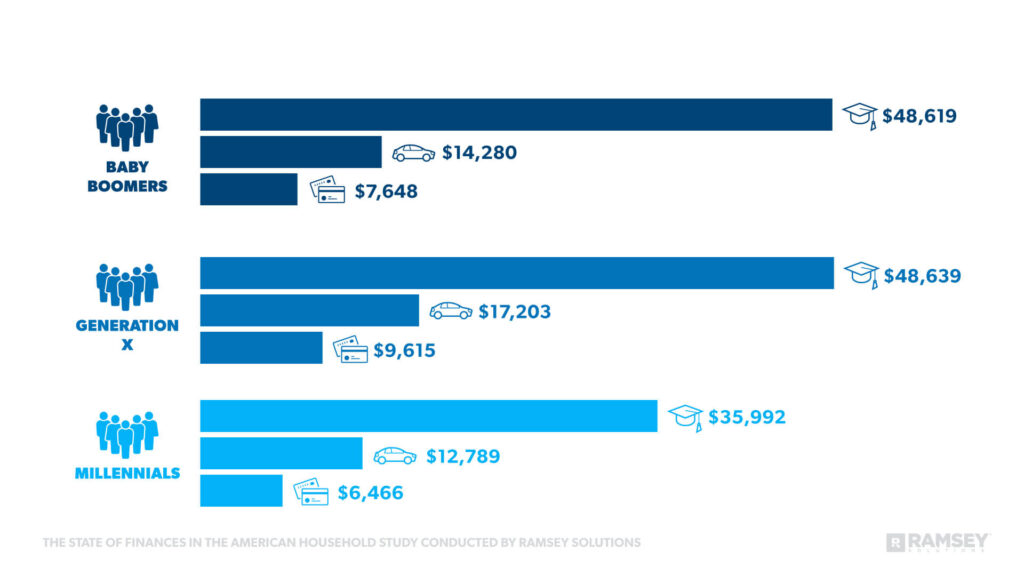

Average American debt refers to the total amount of money that an individual or household owes to creditors, excluding mortgage debt. This encompasses various types of loans, such as credit cards, student loans, auto loans, and personal loans. It is a reflection of the financial obligations individuals have taken on and their ability to repay those debts.

Factors contributing to debt levels

There are several key factors that contribute to the high levels of average American debt. Firstly, the rising costs of education have forced many individuals to rely heavily on student loans to finance their studies. Additionally, the ease of access to credit cards and the allure of instant gratification has led to increased consumer spending. Furthermore, unforeseen medical expenses and stagnant wages have also contributed to the accumulation of debt for many Americans.

By understanding the complexities of average American debt, we can begin to address this pressing issue. Through education, financial literacy, and responsible spending, we can take meaningful steps towards reducing and ultimately overcoming this burden. It is my belief that with the right knowledge and tools, we can empower individuals to take control of their financial futures and create a society where the weight of debt no longer holds us back.

Impacts of American Debt

Financial consequences for individuals

As I delve into the issue of average American debt, it becomes clear that the burden weighs not only on individual households but also on the overall economy. The financial consequences faced by individuals grappling with debt can be overwhelming. The constant pressure to make minimum payments and the accumulation of interest often lead to a never-ending cycle of debt.

Many individuals find themselves unable to save for emergencies or invest in their future due to the heavy load of debt. High debt-to-income ratios restrict their ability to qualify for loans, such as mortgages or business loans, further impeding their financial growth and stability.

Effects on the economy

The effects of American debt extend beyond individual wallets and impact the broader economy. Excessive debt reduces consumers’ purchasing power, causing a decline in consumer spending, which is a crucial driver of economic growth. This decrease in demand can have a ripple effect, leading to decreased production, layoffs, and economic slowdown.

Moreover, the burden of debt can hinder entrepreneurship and innovation as individuals may be cautious about taking financial risks or starting their own businesses. This, in turn, reduces job creation and stifles economic development.

average American debt has significant financial consequences for individuals and negative effects on the overall economy. It is crucial that we tackle this burden head-on by promoting financial literacy, responsible borrowing, and advocating for policies that support debt reduction and economic growth. Only by addressing this issue collectively can we alleviate the strain of debt and pave the way for a brighter financial future.

Challenges in Tackling American Debt

Lack of financial literacy education

Being burdened by debt is a common issue that many average Americans face today. However, addressing this problem is not as simple as it may seem. There are various challenges that hinder individuals from effectively tackling their debt. One significant challenge is the lack of financial literacy education.

Financial literacy plays a crucial role in equipping individuals with the knowledge and skills to manage their finances wisely. However, there is a noticeable gap in our education system when it comes to teaching personal finance. Many people are left to navigate the complex world of financial decisions without the necessary understanding of concepts like budgeting, saving, and managing debt.

Predatory lending practices

In addition to the lack of financial literacy education, predatory lending practices also contribute to the burden of American debt. These practices often target vulnerable individuals who are desperate for quick financial solutions. Predatory lenders exploit the desperation and lack of awareness of borrowers, trapping them in a never-ending cycle of debt with exorbitant interest rates and hidden fees.

It is essential to address these predatory lending practices and provide better consumer protections to prevent individuals from falling victim to these schemes. Additionally, advocating for increased financial literacy education can empower individuals to make informed decisions and protect themselves from such lending practices.

In order to effectively tackle the burden of American debt, it is necessary to address these challenges head-on. By improving financial literacy education and cracking down on predatory lending practices, we can equip individuals with the tools they need to take control of their finances and achieve a more stable and secure future.

Government Initiatives

One of the key players in tackling the burden of average American debt is the government. Its role in debt reduction cannot be understated. The government recognizes the need for intervention to alleviate the financial strain faced by many individuals and families across the nation. Through policy reforms and regulations, the government aims to create a more sustainable financial system and promote responsible borrowing and lending practices.

Role of Government in Debt Reduction

The government plays a crucial role in providing resources and support to individuals struggling with debt. It offers various programs and initiatives aimed at empowering Americans to overcome their financial challenges. These include financial counseling services, debt management plans, and debt relief programs. By providing guidance and assistance, the government helps individuals regain control over their finances and work towards becoming debt-free.

Policy Reforms and Regulations

The government also takes proactive steps to address the root causes of increasing debt levels. It implements policy reforms and regulations to protect consumers from predatory lending practices, such as high interest rates and hidden fees. Additionally, it promotes financial education and awareness to empower individuals with the knowledge and skills needed to make informed financial decisions.

through its initiatives and efforts, the government is committed to alleviating the burden of average American debt. By providing support and implementing necessary reforms, it aims to create a more financially secure and resilient nation.

Tackling the Burden of Average American Debt

Strategies for Debt Management

Creating a budget and financial plan

As I navigate the often daunting world of personal finances, I have come to realize the importance of creating a budget and a comprehensive financial plan in order to tackle the burden of average American debt. By taking the time to assess my income and expenses, I am able to gain a clear understanding of where my money is going and identify areas where I can cut back on unnecessary spending. This allows me to allocate more funds towards debt repayment.

To create an effective budget, I start by listing all my sources of income and categorizing my expenses. This includes fixed expenses like rent or mortgage payments, utilities, and insurance, as well as variable expenses like groceries, entertainment, and dining out. By setting realistic spending limits within each category, I can ensure that I am living within my means and have enough leftover to put towards my debt.

In addition to budgeting, having a financial plan is crucial for effectively managing debt. This involves setting specific goals and creating a timeline for debt repayment. By breaking down my debt into manageable chunks, I am able to focus my efforts on paying off one debt at a time. This not only provides a sense of accomplishment but also helps me stay motivated throughout the process.

Debt repayment options

When it comes to tackling average American debt, there are various repayment options to consider. One approach I have found helpful is the “debt snowball” method. This involves paying off the debt with the smallest balance first while making minimum payments on the rest. As each debt is paid off, I then roll the amount I was paying towards that debt into the next one, creating a “snowball” effect and accelerating my progress.

Another option to explore is debt consolidation. This involves combining multiple debts into a single loan with a lower interest rate, making it easier to manage payments and potentially reducing overall interest costs. However, it is important to carefully consider the terms and fees associated with consolidation to ensure it is the right choice for my specific situation.

Regardless of the chosen approach, it is crucial to remember that tackling average American debt requires discipline, perseverance, and a commitment to making consistent payments towards reducing the balance. While it may seem overwhelming at times, I am confident that by implementing these strategies and staying focused, I can ultimately overcome the burden of debt and achieve financial freedom.

Education and Awareness

In today’s society, it is crucial that we address the burden of average American debt. As each year passes, the amount of debt carried by individuals in this country continues to grow, affecting millions of lives. It is important to tackle this issue by focusing on education and raising awareness.

Importance of financial education

One of the key elements in combating the burden of average American debt is providing individuals with the necessary financial education. By equipping people with the knowledge and tools to make informed decisions about their finances, we can help them avoid falling into debt in the first place. This education should cover topics such as budgeting, saving, and responsible borrowing.

Promoting responsible financial habits

Alongside providing financial education, it is equally important to promote responsible financial habits. This involves encouraging individuals to live within their means, avoid unnecessary debt, and prioritize their financial well-being. By instilling the value of saving and the importance of wise spending choices, we can empower individuals to take control of their financial future.

By prioritizing education and awareness, we can alleviate the burden of average American debt and create a society that is financially secure and resilient. Let us strive towards a future where everyone has the knowledge and skills to make sound financial decisions, ensuring a brighter and more prosperous future for all.

Conclusion

Throughout this article, I have highlighted the current state of average American debt. It is clear that this issue is a significant burden on individuals and families across the nation. Despite the daunting numbers and the potential consequences, there is hope. By taking collective action, we can tackle this problem together and alleviate the financial strain that many Americans face.

Summary of the American debt situation

The average American carries a substantial amount of debt, encompassing credit card debt, student loans, mortgages, and more. These financial obligations have a lasting impact on individuals’ lives, affecting their ability to save, invest, and attain financial stability. It is important for us to recognize the severity of this situation and take steps to address it.

Importance of collective action in addressing the issue

To effectively combat the burden of American debt, we need to emphasize the importance of collective action. This entails educating ourselves and others on responsible financial practices, advocating for policies that support debt reduction and relief, and offering support and resources to those struggling with debt. By working together, we can create a society that is equipped to tackle this issue head-on and provide a path towards financial freedom for all.

In conclusion, it is crucial that we acknowledge the challenges posed by the burden of average American debt. However, by joining forces and taking meaningful action, we can make a significant difference in alleviating this burden and ensuring a brighter financial future for ourselves and future generations. Let us come together as a community and tackle the challenge of American debt for the betterment of us all.